plus/minus epsilon

Derivatives for Banking Better

7 Aug 2021When I was doing the research for my last blog post, I was reading the website for Pacific Coast Banker's Bank and saw that one of the products they offered under "Loan Hedging" was called a back-to-back swap for converting fixed-rate loans to floating-rate. I had no idea what that was and I couldn't see what problem it solved, but I thought it sounded cool at least.

Later, I was researching tenancy-in-common loans and saw in a bank's marketing material:

Due to the lack of a secondary market for TIC loans, we only offer Adjustable-Rate Mortgages at this time.

which clicked in my head with back-to-back swaps and prompted me to dig deeper.

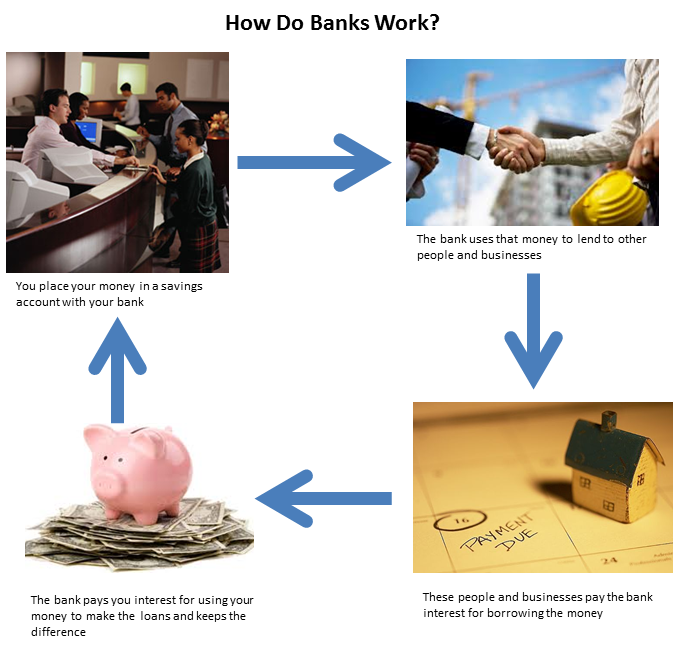

As I discussed in my last post, the basic way that a bank works is:

- Receive deposits from customers by offering checking and savings accounts, as well as CDs.

- Invest the deposits in loans that bear interest.

- Use the interest payments and origination fees to pay yourself and pay your customers interest on their deposits.

The biggest risk posed to this business model is called Interest Rate Risk. With the simplified business model above, our bank risks failure if interest rates change in either direction:

- Imagine that all of our bank's deposits were received in its first year of business, in the form of 5-year 5%-yield CDs when the market rate for most loans was 5%. We invest those into mortgages with 5% interest. In our second year, the market rate drops to 1% and all of our mortgage borrowers immediately refinance at 1%. As a result, we'll likely default on the CDs we issued because there are no more 5% investment opportunities.

- Imagine that all of our bank's deposits were received in its first year of business, in checking accounts with floating interest. We invest those into mortgages earning 1% interest which is the market rate. In our second year, interest rates jump to 5%. But since we already invested in 1% mortgages and there's no significant number of new mortgage applications, 1% is the most we can offer on deposits. Our depositors become frustrated with their low return and move their money to a better bank, forcing us to liquidate ourselves out of business.

The problem here is that consumers overwhelmingly demand short-term floating-rate returns on deposits and a guaranteed return on CDs. But they also want long-term fixed-rate financing with the ability to refinance when it's favorable. So when we invest short-term deposits into long-term loans, the moment that interest rates change, either borrowers or depositors will be unhappy.

Swaps

This is what motivates the use of back-to-back interest rate swaps.

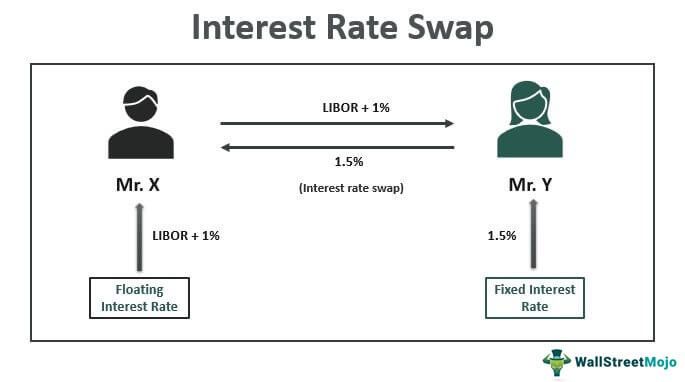

Intuitively, a swap is a contract between two people that borrowed/lent the same amount of money but want to switch interest payments. Maybe person A wants a fixed-rate but was only able to get floating, and person B wants floating but was only able to get fixed-rate. So they just agree to pay/recieve each other's interest payments instead.

Critically, at the beginning of the swap, it's important that both parties expect that the payments will be the same amount over the long-term -- the different interest rates should even out. In reality though, the floating rate may be unusually high or low and it'll become apparent that one side is likely to pay/receive more than the other. This is what makes swaps a tool for speculation: if you believe the floating rate will behave a certain way, you can enter into swaps (without actually borrowing/lending money -- just agreeing to make the synthetic interest payments with an actual lender/borrower) and if you're right you'll make money!

Application

Why are swaps useful to banks? Let's go back to the two example scenarios above where our bank failed:

- Previously when interest rates went down, we were unable to find investments that could meet our obligations to CD depositors. If instead we used a swap with an investor, where the investor pays the fixed 5% interest to our customer and we pay a floating rate to the investor, then when rates went down so would our obligations to the investor making it much more likely that we'd be able to meet them.

- Previously when interest rates went up, we had already invested all of our money into low fixed-rate mortgages and were unable to offer better rates on deposits. If instead we used a swap with an investor, where the investor makes floating-rate payments to us and receives the fixed-rate payments from our borrowers, then when rates went up so would our payments from the investor and we would be able to immediately offer higher rates on deposits.

Swaps are derivative securities, and like all derivatives their purpose is to move risk from people that don't want it (our bank) to people that do (speculative investors). Banks handle the money that people use day-to-day for living expenses and have an incredibly low tolerance for failure, while investors are specifically looking to speculate and are using only money that can be lost. For banking needs that don't have a well-developed investor market, the bank has no choice but to push risk to depositors or borrowers instead. In the case of TIC loans, the borrowers are forced to assume more risk by taking a floating-rate mortgage instead of using a fixed rate.