plus/minus epsilon

Financial Independence Strategies

13 Dec 2020A while ago, I tweeted that “it’s essentially always cheaper to rent in urban areas than it is to buy property.” I believe this is conventional wisdom called the Rule of 16, where you divide the price of a house by the yearly rent of a similar apartment. If the ratio is over 16, it’s “better” to rent in that area than it is to buy and vice versa. I’m not sure where that rule came from and I’ll try to derive it later, but I decided to check this assumption by modeling it.

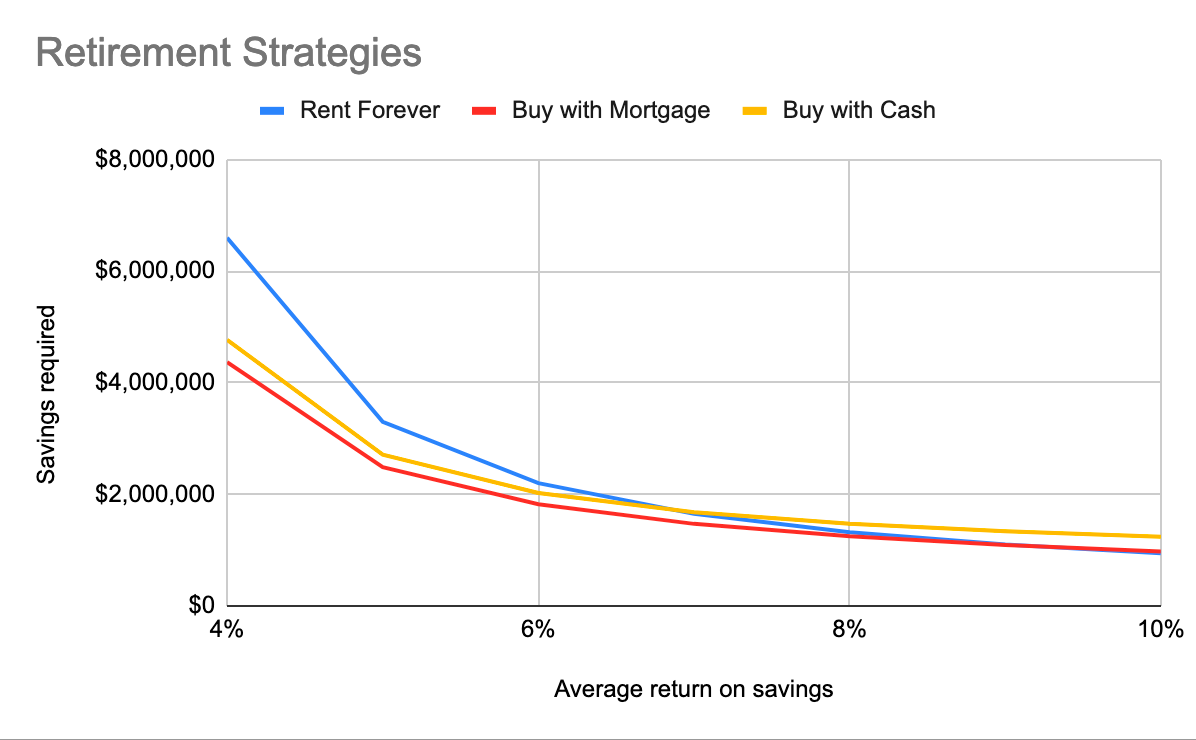

The approach I took was to calculate the price of a perpetuity that would pay my rent, bills, food, and shopping expenses assuming a modest degree of inflation. I compared this to the strategy where I buy a house with a mortgage with 20% down, purchase a 30-year annuity that pays the mortgage, and a separate perpetuity that pays for bills, food, shopping, property tax, HOA, and repairs. I also checked a third approach, which is to buy a house with cash directly instead of using a mortgage.

So the output of each model is the number of dollars that I need today to cover all my expenses until my untimely demise, assuming that I’m able to get some given return on my savings. Here are the results, as a graph:

For reference, my rent is $3k/mo and the price for a similar condo is about $650k. Obviously buying with cash is always slightly more expensive than a mortgage because mortgages are heavily subsidized. However I was surprised that despite living in an area where the Rule of 16 says I should rent, it’s essentially always long-term cheaper to buy.

In general, the difference between buying and renting is so small in the 7-10% range that whichever is “right” for an individual likely comes down to individual factors that are harder to quantify.