plus/minus epsilon

HOA Operations

14 Jun 2022Given that an HOA is a relatively simple business, it feels like it should also be simple to tell if an HOA is “properly run” in the sense that it’s expected to be solvent in the long-term without Special Assessments.

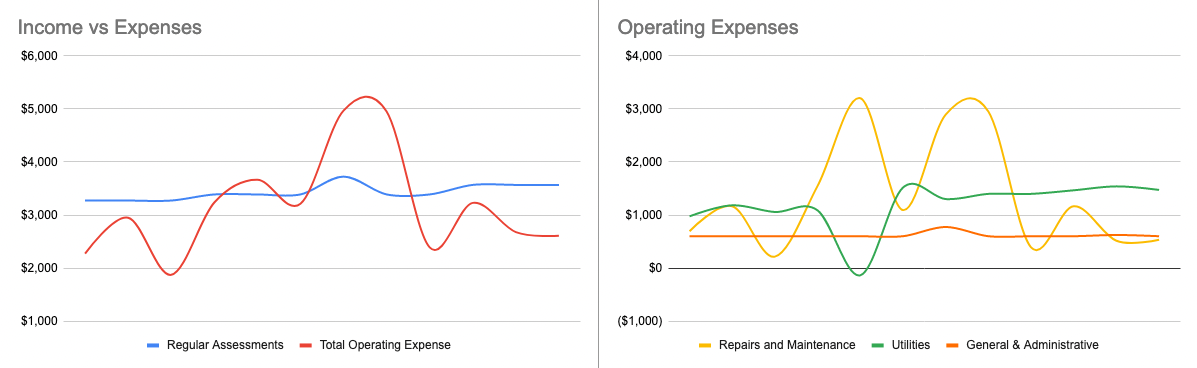

If you look at the income statement for an HOA, it has two income lines: Regular Assessments, and Special Assessments. Regular Assessments are fixed amounts paid by each member monthly, while Special Assessments are used specifically for unexpected budget shortfalls. The income statement for an HOA also has three expense lines: Repairs & Maintenance, Utilities, and General & Administrative. R&M covers the expenses incurred to keep the property in its original condition. Utilities covers the expenses for shared utilities like sewer, garbage pickup, or electricity for common areas. And finally, G&A covers the cost of property management and bookkeeping.

The above graphs show the income and expenses of an example HOA over one year. In this particular year, the income from regular assessments is, on average, slightly higher than the expenses. Intuitively this would seem to indicate that the HOA is solvent, and could maybe even lower it’s dues to match the average of expenses!

The problem is that HOAs need to save and make investments over decades – a one year snapshot is far too short to understand an HOA’s performance. A typical multi-unit building will likely need:

- To be repainted every 10 years

- Updated electronic systems (like an intercom or garage door opener) every 15 years

- A new roof every 20 years

- New windows every 30 years

And potentially even stone flooring and concrete will need to be replaced after 40 or 50 years. All of this constitutes hundreds of thousands of dollars in expenses that need to be anticipated and saved for, for years before the maintenance actually needs to be done.

This leads us to think about HOA expenses as coming in two categories: long-term investments and short-term keeping the lights on. That’s also why HOAs have two bank accounts: the Operating Account, and the Reserve Account. Expenses corresponding to Utilities and G&A are paid from the Operating Account, while R&M is paid from the Reserve Account. When dues are received, some fixed portion goes into the Operating Account while the remaining amount goes into the Reserve Account.

Each bank account has a different mental model, which is a direct result of the previous point that HOAs make both short and long-term investments. The Operating Account really does follow the intuitive “deposits = average withdrawals” model, meaning that it has an average balance of zero. The expenses the Operating Account covers are short-term and stable, so there’s no particular need to plan very hard for them.

On the other hand, the Reserve Account can be thought of as comprising many sub-accounts, one for each maintenance project. The monthly dues are evenly spread across each sub-account, and the sub-account balance for a project builds up until it reaches the expected cost of the project right around the time the project needs to be paid for.

This is why it’s slightly tricky to understand the income statement, because the R&M expenses don’t particularly matter if they were planned for. In one year the R&M expenses might be significantly greater than income, while in another year the opposite may be true. What matters is whether the Reserve Account balance, and the contributions to reserves, is enough to sustain the anticipated maintenance costs. With one important note: the proportion of income that’s contributed to reserves isn’t anywhere in the financial statements! It has to be computed backwards by taking income and subtracting the Utilities and G&A expenses.

In short, for an HOA to be solvent, it’s not that it’s income needs to be greater than the average combined R&M, Utilities, and G&A costs. It’s solvent if it’s income is greater than the average combined Utilities and G&A costs, plus a contribution to reserves that can be expected to fund a plan for future maintenance. Of course, it also matters whether the plan itself is any good but that’s subjective.