plus/minus epsilon

Reading Sterling's 10-Q

18 Jul 2021Today I decided to read Sterling Bank's most recent 10-Q, to get a better understanding of how a savings and loan bank works. This blog goes through it at a high-level with commentary and graphs.

Balance Sheet & Income

Sterling's proper name as a public company is Sterling Bancorp, and they refer to themselves as a unitary thrift holding company. A thrift is just a word for a savings and loan bank, and unitary means that Sterling is the only thrift in the holding company.

As a thrift, they operate by taking deposits from individuals and businesses by offering checking and savings accounts, and loaning that same money to others. The bank's day-to-day income comes from the fees it charges for originating loans, and from interest on the loans in its portfolio. If they need additional cash, they have the option to sell their loans to other investors or pledge some or their loans as collateral for a loan from the Federal Home Loan Bank (FHLB).

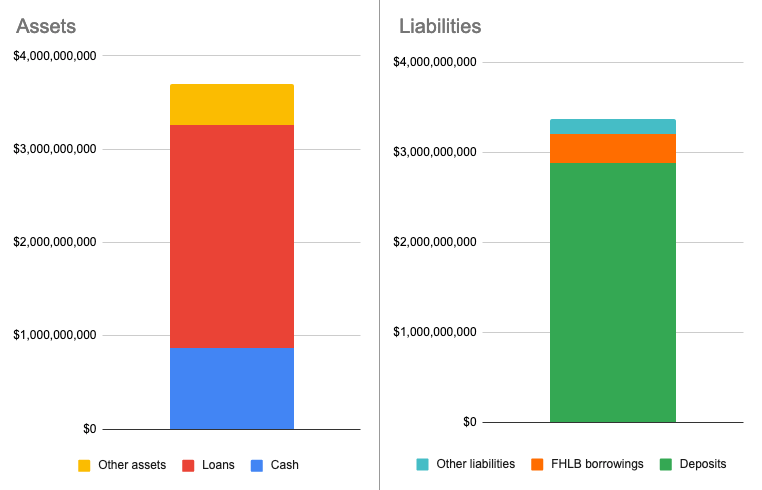

Currently Sterling has about $2.9B in deposits from customers and $300M in advances from the FHLB, along with about $300M in retained earnings. Of this, it keeps $900M in cash, $2.4B invested in loans, and $300M in other assets including securities.

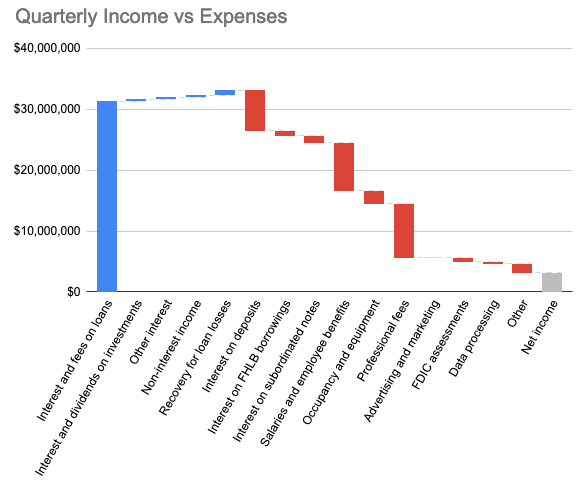

As I mentioned above, the vast majority of their income is from interest collected on loans. Their interest income is split up into pretty even chunks: one third given back to customers, one third on staff, and the last third on "professional fees" which is mostly lawyers and compliance consultants.

In 2019, Sterling announced that they were suspending their Advantage Loan Program, which comprised the vast majority of their loan originations, after discovering that their underwriting standards weren't compliant with regulation and that they were misrepresenting the loans they sold to investors. They were sued by their investors as well as put under investigation by the OCC, which is the cause of the higher-than-ideal professional fees expense. They also have a reserve fund, classified under "Other assets" in the balance sheet, where they keep money dedicated to repurchasing the bad loans they sold.

Management Discussion

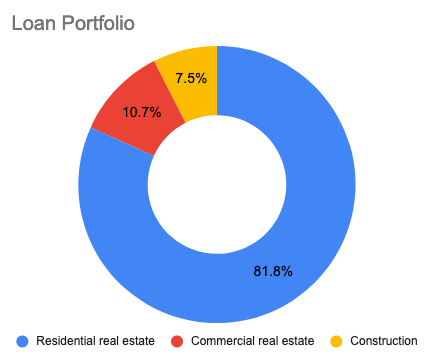

COVID-19. Sterling is notable in the Bay Area for being one of the few banks that are able to finance tenancy-in-common housing. Because of this, their loan portfolio is overwhelmingly in residential real estate:

Management notes that this creates a variety of risks due to the fact that their loans are concentrated in specific areas of California and that major hits to the economies in those areas directly affect them. In particular, COVID-19 has noticeably affected loan performance even if you account for forbearance.

Investments. Sterling's equity investments are split between a publicly-traded mutual fund, and the thinly-traded restricted stock of Pacific Coast Bankers' Bank. A banker's bank provides more complicated financial services and benefits of scale to smaller community banks, though it's unclear why Sterling invested in them.

Repurchasing Stock and Issuing Dividends. While the company was previously using spare cash to repurchase its stock or issue dividends, it's currently paused while investigations into the Advantage Loan Program are ongoing. Probably related but also possibly not, they currently have an excess of liquid funds.

Personal Take-Aways

Operating a thrift is a three-body problem: you need to attract borrowers, you need to sell them loans that you can re-sell to investors later if you need liquidity, and you need to make enough money from that process to give back to your customers whose money you're using.

One approach is to offer loans with the lowest interest rate that you can sell to investors, hoping to attract enough borrowers that you can redistribute the origination fees as interest. But this is undifferentiated and can be unreliable; for example, last quarter Sterling originated $46.9m in loans while in the same quarter last year they originated $185.4m.

The approach that I believe Sterling takes, is to offer niche loan products (particularly for tenancy-in-common housing) which command higher interest rates due to the lack of competition. Then the interest payments on loans can be directly given back to customers. This is differentiated and more reliable, but has other risks. The high leverage helps explain their high return, but it doesn't explain how they have access to cheap enough borrowed funds that the interest doesn't out-pace a municipal bond.